2025 Analytical Draft Grades: NFC

Quantifying trade, positional and selection value for the most accurate and predictive assessments of how well teams did in the NFL draft

Three days, seven rounds and 257 picks later, the culmination of months of planning and detail for 32 NFL franchises has come and gone. All that’s left now is to sort through the results. Last year, discussed in detail why parsing the noise for signal in draft grading can be so difficult, mostly because the draft media industrial complex doesn’t focus on what’s most important and predictive.

Draft content is mostly about who will be the best players in the NFL, so that’s also what drives most draft grades. The problem is that all the research around the draft shows that giving kudos or demerits based on how teams drafted versus your expectation is a fool’s errand. There’s only a little correlation between a loss in value when teams reach for a player versus consensus, and nearly no correlation if they draft a player later that we think they’ll go before the draft. As I explained in my draft grading philosophy primer:

It isn’t that prospect evaluation doesn’t matter, it’s that NFL teams pour so many resources and expertise into the task that relative success and failure will be narrow, especially over a longer timeline. You shouldn’t take away from the data that no teams are really good at prospect evaluations. Instead it’s that all teams are really good, and likely much better than outside evaluators.

While we can’t rely too heavily on the specific prospects the team chose at there draft slots, there are larger macro forces that teams can leverage to, on average, better their draft outcomes. The two primary drivers of quantifiable draft value are:

Trade value gained/lost

Positional value gained/lost

There are extended bodies of research on the value teams can gain trading back in the NFL, and in this analysis I quantify that value through looking at the equivalent value in NFL salary of players similar to those drafted. Rookie contracts are set at artificially low amounts, so the difference in player value over contract value is what the team gains with each draft selection, or surplus value. Different positions are valued much differently in NFL contract markets, so hitting on an All-Pro level running back in the draft gives less surplus value at a particular draft selection than landing an elite edge rusher. When teams are faced with the choice of wear to allocate their draft capital, especially in early rounds, accounting of positional value will skew the odds of success in their favor.

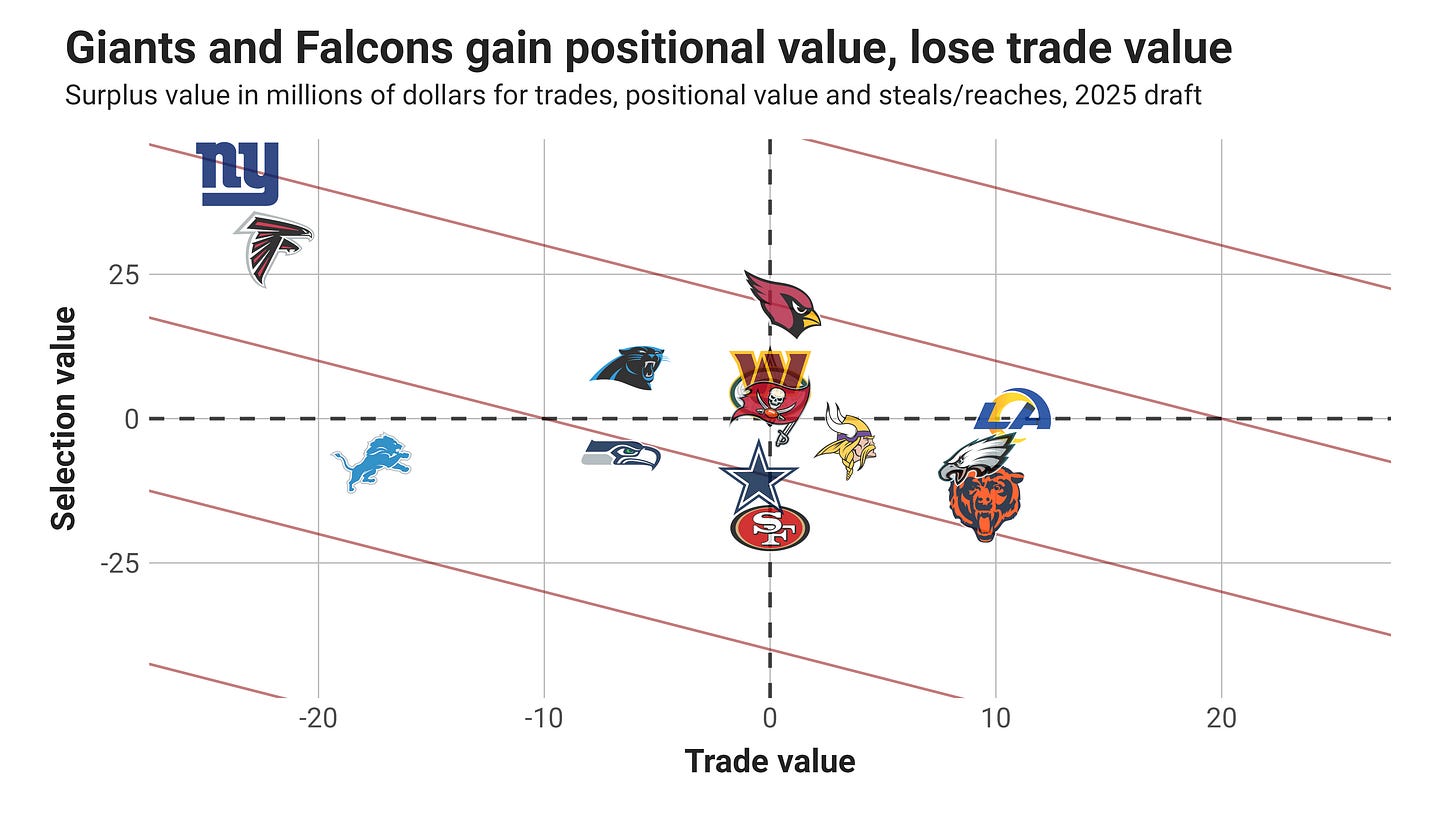

Looking at all the NFC teams in terms of value added ($M) in trades (average expected surplus of picks traded away versus those gained) and what I call selection value (a combination of positional value and a much smaller contribution from taking players after/before their consensus value), you can see that a couple big trades skews the results, and how powerful the impacts of those trades can be.

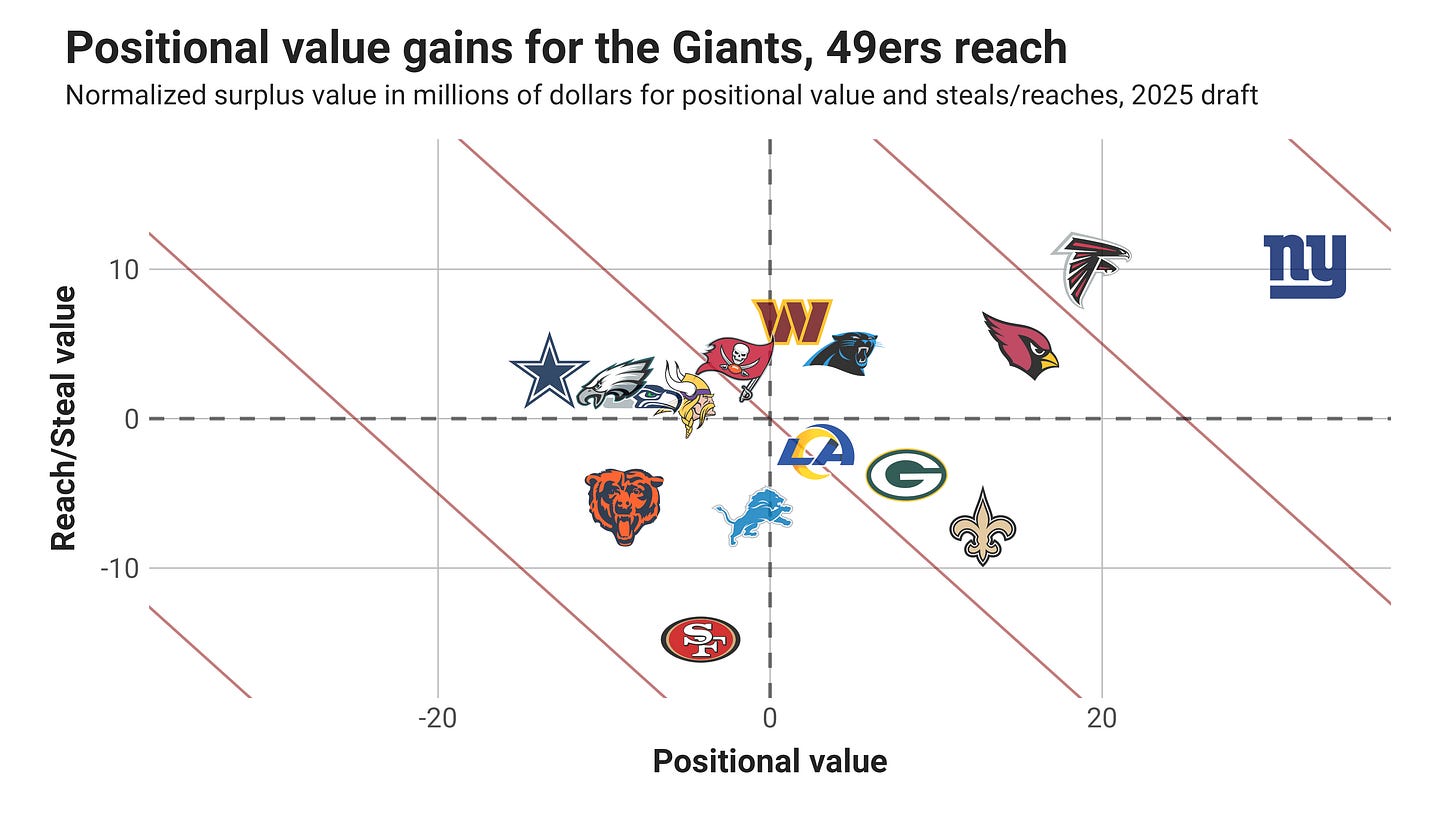

The New Yorks Giants and Atlanta Falcons took bold swings with big trade-ups, gaining positional value in the process. Digging further into the two components of selection value, we see that positional value has a bigger relative impact, more than three times the standard deviation of value gained by drafting players versus consensus rankings.

The reach/steal paradigm is going to be the primary driver of most draft grades you see from media analysts this week, yet’s it’s least impactful. Research shows that steals are much less likely to produce benefit than reaches cause harm, so you should be especially skeptical of draft grades that lean heavily into teams who drafted the most players far after their consensus expectations.

Let’s get to our analytical grading, going through each NFL division here. Again, if you want more details why I believe this is the best method for analyzing drafts in a predictive manner, check out my draft grading primer.

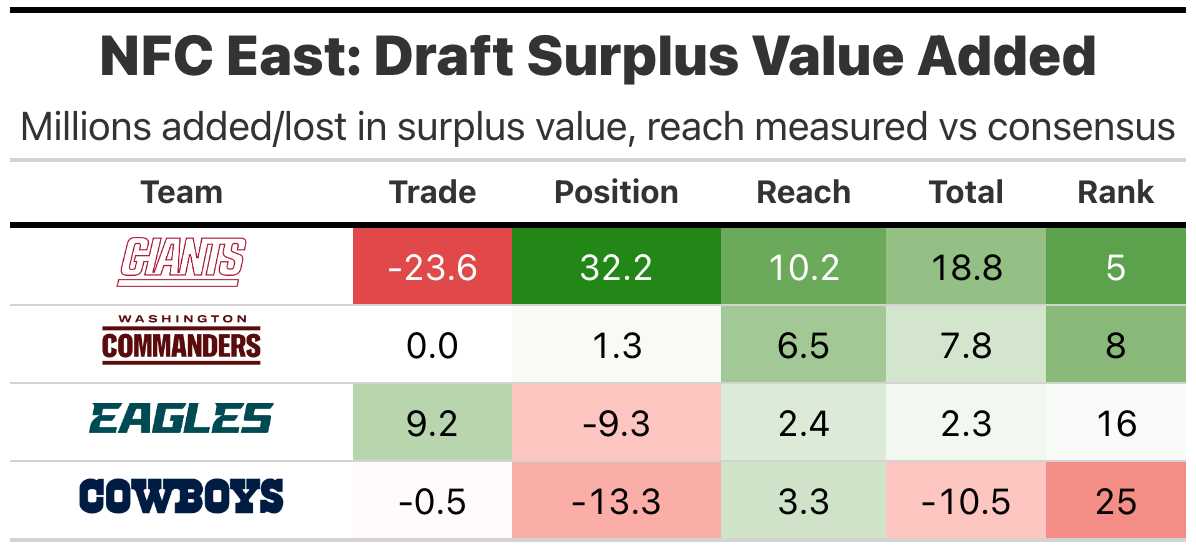

The aforementioned New York Giants land at 5th overall in their total surplus value gained, with big positional and “Reach” value added relative to the rest of the NFL. While the Giants selecting Jaxson Dart with the 25th pick was substantially earlier than his consensus rankings (51 Big Board, 33 Mock Draft), he offset that cost with roughly $20 million of assumed positional value over expected, based on draft slot. The Giants added positional value with the selection of edge rusher Abdul Carter at No. 3, a “tier 1” position among non-quarterbacks. Those gains were enough to offset smaller losses on their other selections.

The Washington Commanders weren’t active in the trade market, but had marginal gains in positional value and were disciplined not reaching for prospects. Their first two picks - offensive tackle Josh Connerly and cornerback Trey Amos - were taken with combined draft position of 90 (29th and 61st) and a combined consensus big board ranking of 73 (33rd and 40th).